Issue 1: A Knowledgeable Way to Evaluate an OCIO Provider

July 2020

RVK’s Outsourced Chief Investment Officer (OCIO) Evaluation and Monitoring Team (RVK OCIO E&M Team) has been conducting OCIO education, search, evaluation, and monitoring projects for over seven years. Throughout this time, we have advised asset owners on how to navigate the particular challenges associated with evaluating OCIO providers. In RVK’s first edition of OCIO Insights, we highlight elements often overlooked by asset owners when evaluating an OCIO provider—Board/Investment Committee governance structure, key components in understanding a track record, and due diligence on business aspects of an OCIO. Below are summaries of the three elements we review in the publication. The complete RVK OCIO Insights publication can be found here.Board/Investment Committee Governance Structure Matters

Based on our experience working with fiduciaries, we have observed the importance of alignment between an asset owner’s governance model and the OCIO provider’s service model in fostering a successful engagement, and how often that alignment is assumed to exist. The concept of governance/service model “alignment” includes many aspects of an asset owner/OCIO provider relationship: meeting attendance, communication of key investment actions and their drivers, transparency in affirming compliance with investment policy and risk limitations, as well as key organizational changes, content of investment reports, and, perhaps most importantly, a clear agreement regarding which party has ultimate decision-making authority over various portfolio management decisions.

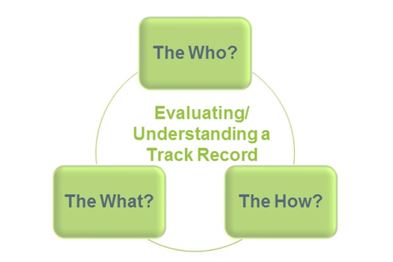

Track Records Matter, but they are not the Primary Decision Point

When searching for a particular investment product, whether a small cap equity mutual fund or a middle market buyout fund, one of the first items up for scrutiny by a potential investor is the proof statement that the fund has been successful—its track record. That track record, measured against a benchmark, often determines if an investor will conduct additional research on the fund itself. While there may be a tendency to focus on results, we believe appropriately evaluating a track record is rooted in understanding the investment basics of who, how, and what led to that historical track record.

Read more about three key components in understanding an OCIO provider's track record

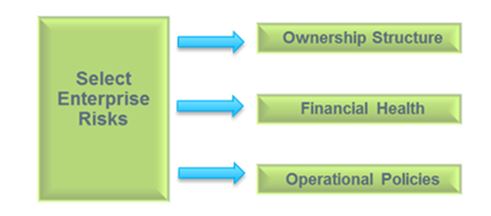

Due Diligence Beyond Investments/Portfolio Management

One of the primary reasons Boards/Committees implement an OCIO model is the expectation that it will improve performance. Given that objective, many investors tend to focus their due diligence on evaluating an OCIO’s resources and processes directly related to investment portfolio management and performance, such as key investment personnel, portfolio construction processes, asset allocation structuring, manager selection processes, and performance metrics. However, OCIO providers are businesses and thus present clients with enterprise risk as well as investment risk. Conducting due diligence on the business aspects of an OCIO provider and understanding the potential risks associated with various elements of an OCIO’s organizational structure is equally as important as investment management and performance. Without a stable and sustainable business model, the success and longevity of an OCIO provider is questionable. Part of RVK’s comprehensive evaluation of an OCIO includes an analysis of the enterprise risks of the firm.